puerto rico tax incentives 2021

O Section 40309 relating to income attributable to domestic production activities in Puerto Rico o Section 40311 relating to empowerment zone tax incentives o Section 40414 relating to the special rule for sales or. Domestic corporations are allowed to claim a credit for any income taxes paid to a foreign country provided that the taxes are not claimed as deductions.

Puerto Rico Tax And Incentives Guide Grant Thornton

100 tax exemption from Puerto Rico income taxes on all short-term and long-term capital gains.

. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Wisconsin Tax Bulletin 212 February 2021. 100 tax exemption from Puerto Rico income taxes on all cryptocurrencies and other crypto assets.

Foreign corporations are not allowed foreign tax credits. Is a town and municipality in the northern coast of Puerto Rico 15 miles 24 km west of San Juan and is located in the northern region of the island bordering the Atlantic Ocean north of Toa Alta east of Vega Alta and west of Toa BajaDorado is subdivided into five barrios and Dorado Pueblo the downtown area and the administrative. You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any other issues related to taxes or residency in Puerto Rico.

Corporate - Tax credits and incentives Last reviewed - 31 December 2021. Just keep in mind that to qualify for these generous incentives you must become a bona fide resident of Puerto Rico which involves spending the. Located in the Condado district in San Juan 37 mi from Fort San Felipe del Morro AC Hotel by Marriott San Juan Condado features a year-round outdoor pool and spa center.

This property is 3 minutes walk from the beach. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US.

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

A Red Card For Puerto Rico Tax Incentives

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives Can Puerto Rico Have Nice Things

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Puerto Rico Tax Incentives Defending Act 60 Youtube

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Save On Corporate Tax In Puerto Rico With The Act 60 Export Services Tax Incentive Relocate To Puerto Rico With Act 60 20 22

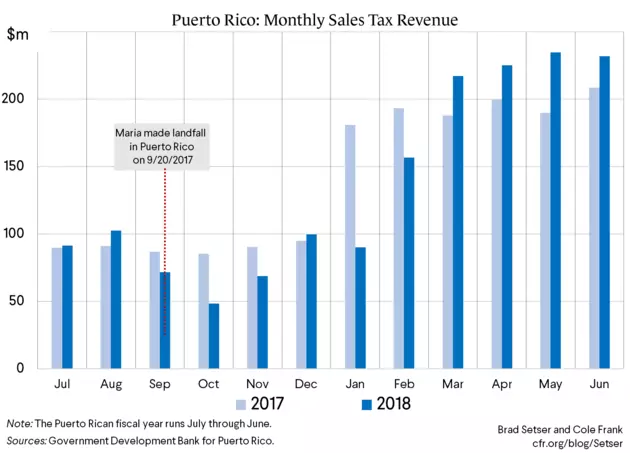

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Tax Act 60 Jen There Done That

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico

Guide To Income Tax In Puerto Rico

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22